Rasmussen Reports has a reputation of accuracy and is reporting consumer reaction to The Walt Disney Company that has some gasping in surprise. If you think our modern political candidates are divisive (or perceived as such), they’re still not on par with where Disney has placed itself by weighing in on controversies. Perhaps that “not-so-secret agenda” was a bad idea after all?

MAKE UP BOY in THE PROUD FAMILY: LOUDER AND PROUDER – “Bad Influencer” (Disney)

The political website FiveThirtyEight, which ranks pollsters according to their own rubrics, gives Rasmussen Reports a -0.3 rating for accuracy in which a negative number is considered excellent. This gives them an equal score with other reputable polling firms such as University of New Hampshire Survey Center, Public Policy Institute of California, and University of California Berkeley Institute of Governmental Studies.

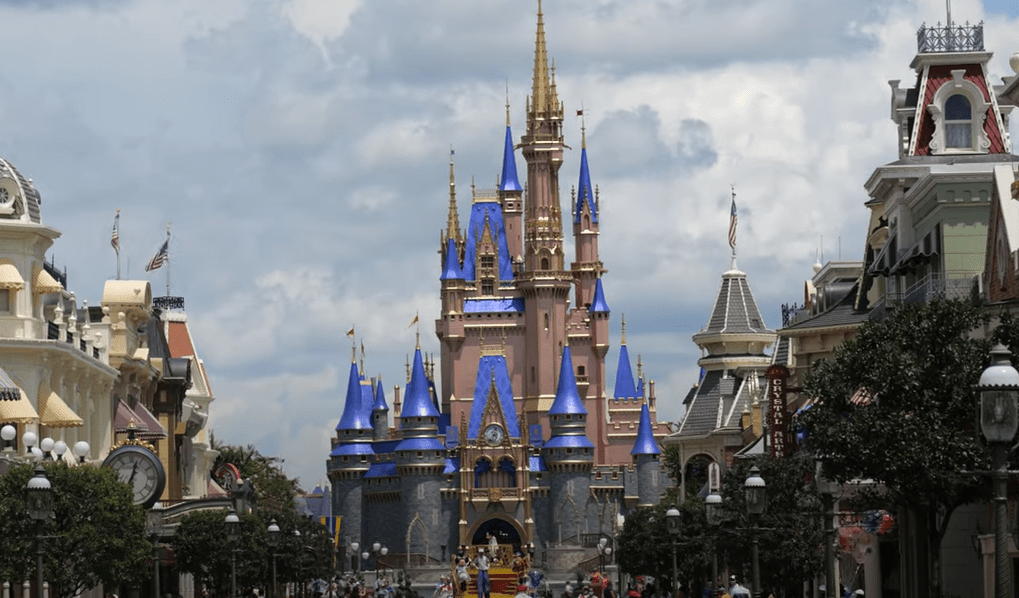

In Rasmussen’s latest polling on Disney, the firm found that The Walt Disney Company had an astounding 40% of respondents rate it as an unfavorable company. However, that poll was taken in 2023. Today, as the Disney stock is hammered due to crashing box office and theme park demand, Rasmussen has found that the unfavorability of Disney has actually increased to 45%. That would be atrocious for a politician… but for a company that is intended to generate content families feel is safe for children, it’s catastrophic. You might consider, for example, that if a fast food restaurant had even a 10% unfavorable rating, it would correlate to a significant decrease in sales. But for a company that is essentially a family entertainment corporation, having such a high unfavorable rating is monumentally more challenging for address.

But it actually gets worse.

According to Rasmussen, Disney’s favorability is not even in positive territory any longer. And despite Disney wading into very divisive topics with confidence of its moral superiority, the company now has a lower favorability than former president Donald Trump. The reason for this is that not every survey-taker decided to vote in a positive way for Disney if they avoided the unfavorable response. A significant number of poll-participants found a middle ground of not taking either side. And that means Disney is actually in negative water.

Poll findings from Rasmussen Reports; Copyright Scott Rasmussen

The survey arrives as Disney’s stock tumbled more than 10% at times during trading on Tuesday during an earnings call in which Bob Iger was finally free from the pesky Nelson Peltz and his attempts to get a seat at the Disney Board. Clearly things did not go well. And, perhaps even more clearly, the survey results found by Rasmussen seem to have parallel findings to the market at large.

The titan of entertainment known to many as the Mouse House, reported earnings for the March quarter that surpassed the expectations of Wall Street analysts in many ways. But consumer distaste for the company seemed to scare both the C-Suite and the investors who listened in. The company’s shares experienced a notable decline. By midday Eastern Time on Tuesday, Disney’s stock had fallen by 10.4%, trading at $104.41, and ultimately closed the day at $105.39, marking a decrease of 9.5%. This downturn followed a robust year-to-date increase of 29% as of Monday’s close… but much of that may have been attributed to the proxy battle between Nelson Peltz and Disney during that time.

The financial fortitude of Disney’s Parks and Experiences was relayed as a bright spot, driving both top-line revenue and bottom-line profits during the first quarter of 2024. Revenues in this segment rose by 10%, while operating income saw a 12% increase. Despite these gains, Disney has tempered expectations for the forthcoming June quarter, projecting that segment operating income will likely mirror last year’s figures, with revenues expected to remain flat. More on that in the coming days as we dive into what might have given Disney the Hong Kong boost for Disney Parks in the reported quarter. But clearly, with streaming in trouble and the parks losing interest, shareholders saw the writing on the wall. It looked much like what Rasmussen was seeing as well.

For all the news that should be fun, keep reading That Park Place. Drop a comment down below!