Trian Fund Management Founding Partner Nelson Peltz reacted to losing his proxy fight against The Walt Disney Company claiming that if Bob Iger keeps his promises he and Disney won’t hear from him again.

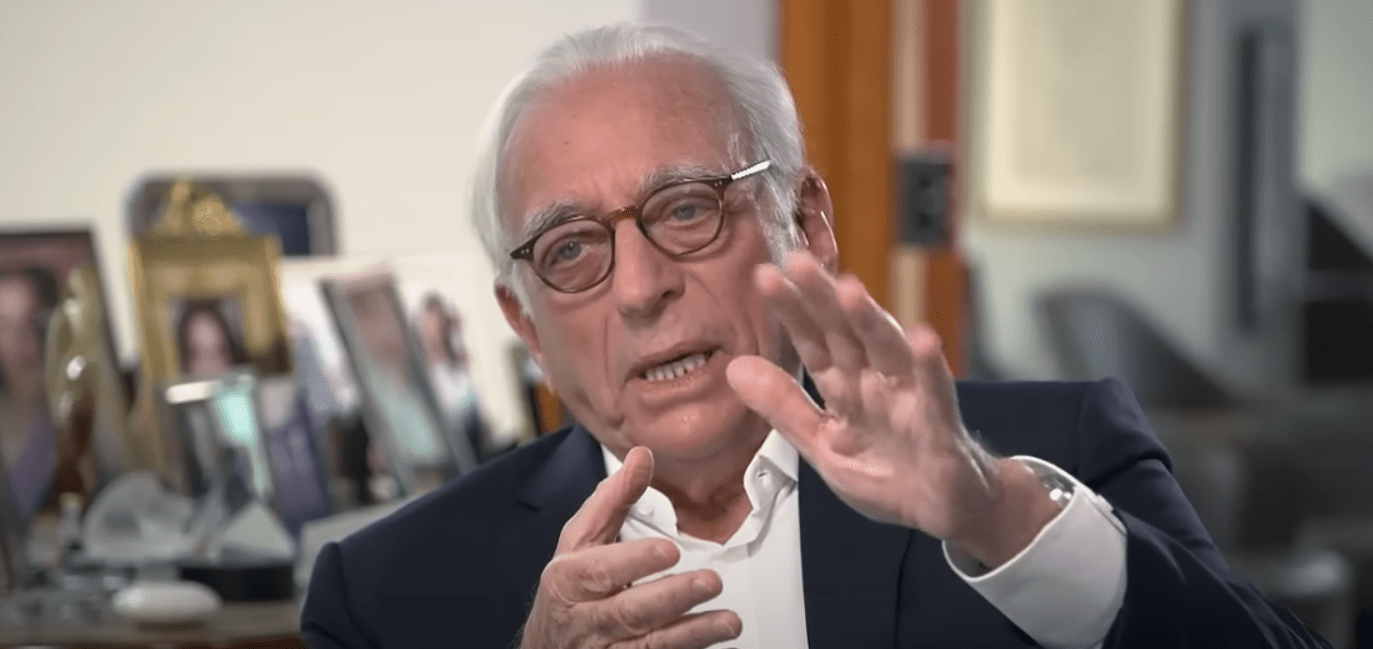

Nelson Peltz via David Rubenstein YouTube

During an interview with CNBC, Peltz said, “I hope this is not a redo of last year, where we pulled out, gave management a chance, and the stock went down from roughly $120 down to $79. I hope that doesn’t happen this time. Whether we stay or not, we don’t make those kind of announcements.”

He continued, “I hope Bob [Iger] can keep his promises. I hope they can do all the things they assured us they were going to do. And we’ll only watch and wait. If they do it, they won’t hear from me again. If they don’t, Jim [Cramer], you may be seeing me on your show next year doing this same thing again.”

“So, it’s really up to management, it’s up to the board, it’s up to whether they do what they say they want to do, or if it’s the same old story again,” Peltz went on.

READ: Nelson Peltz Slams Disney For Being Woke: “Why Do I Have To Have A Marvel That’s All Women?”

He specifically took issue with the company’s succession plan, “Look, they’ve got to get a succession plan firmly in place that works. We haven’t seen one going back to 2011, they began talking about succession. We’re 13 years from then and they haven’t come up with anything.”

“They’ve got to get the margins up, they got to get streaming right. They made a lot of promises. And, frankly, as a shareholder, I hope they keep them, but if not we’re here,” Peltz said.

Nelson Peltz via David Rubenstein YouTube

Peltz later said, “Look, I’m willing to give them the opportunity to prove me wrong. I’m willing to give them the opportunity to do as they say. The shareholders who voted, they want to give management and the board a chance. So, so be it, we will watch like we did last time.”

“We pulled out a year ago February, a lot of promises were made, we hoped that they were going to keep them. They didn’t. We came back. We’ve got a new set of promises and I hope they keep them. And if they do, I’ll be a guest on your show probably talking about a different company. But if they don’t, you’ll see me again, Jim,” Peltz concluded.

Brie Larson as Captain Marvel/Carol Danvers in Marvel Studios’ THE MARVELS. Photo courtesy of Marvel Studios. © 2023 MARVEL.

In a press release, Trian reacted to the results, “While we are disappointed with the outcome of this proxy contest, Trian greatly appreciates all of the support and dialogue we have had with Disney stakeholders. We are proud of the impact we have had in refocusing this Company on value creation and good governance. Since we re-engaged with the Company in late 2023, Disney has announced a host of new operating initiatives and capital improvement plans. The Board has been refreshed with two new directors. Over the last six months, Disney’s stock is up approximately 50% and is the Dow Jones Industrial Average’s best performer year-to-date.”

“We thank Trian’s investors for the confidence they have placed in our efforts. And, we wish the best for all of the Company’s stakeholders, including Disney’s Board and management team. We will be watching the Company’s performance and be focusing on its continued success,” the statement concluded.

Nelson Peltz via CNBC Television YouTube

READ: What’s Black And White And Red All Over? Nelson Peltz’s Trian “White Paper”

Peltz and Trian Fund Management have criticized the leadership of The Walt Disney Company and its Board of Directors over the past year declaring in January 2023 that The Walt Disney Company “is a company in crisis with many challenges weighing on investor sentiment.”

Specifically the firm detailed the company has poor corporate governance, poor strategy and operations, and poor capital allocation. The firm also noted it wanted to “refocus the creative engine to drive profitable growth.”

As Peltz noted in his interview with CNBC, he and Trian did pull away from a proxy fight in February noting, “We congratulate Disney and Bob Iger on their recently announced operating initiatives, which are a win for all shareholders and broadly align with our thinking. We are pleased with the role that Trian was able to play in helping to focus the Board to take decisive actions which we believe will lead to better financial results. We were also pleased to see the Company’s pledge to restore the dividend.”

Emperor Palpatine in a scene from “STAR WARS: THE BAD BATCH”, season 3 exclusively on Disney+. © 2024 Lucasfilm Ltd. & ™. All Rights Reserved.

However, the proxy battle would reignite in November with Peltz saying via a press release, “Since we gave Disney the opportunity to prove it could ‘right the ship’ last February, up to our re-engagement weeks ago, shareholders lost ~$70 billion of value. Disney’s share price has underperformed proxy peers and the broader market over every relevant period during the last decade and over the tenure of each incumbent director.”

He added, “Investor confidence is low, key strategic questions loom, and even Disney’s CEO is acknowledging that the Company’s challenges are greater than previously believed. While James Gorman and Sir Jeremy Darroch represent an improvement from the status quo, the addition of these directors will not, in our view, restore investor confidence or address the root cause behind the significant value destruction and missteps that this Board has overseen. Trian intends to take our case for change directly to shareholders.”

Halle Bailey as Ariel in Disney’s live-action THE LITTLE MERMAID. Photo by Giles Keyte. © 2023 Disney Enterprises, Inc. All Rights Reserved.

What do you make of Peltz’s response to losing his proxy battle?

I do appreciate his tenacity to be a constant pain in Iger’s behind.

DEI survived. Fantastic Four proves it. The next 3 years will be more box office failures. No accountability.

Every imminent failure will be under even closer scrutiny than 2023’s Dis-turds. It’s only going to get worse. Iger and The Wokes can’t help themselves.